Sage Intacct Sync Guide: Create a Clearing Account in Intacct

- J.P. Morgan Digital Banking Cashflow360 Money Out Clearing account

- J.P. Morgan Digital Banking Cashflow360 Money In Clearing account

If you've set debits and credits to your bank account to show as consolidated for each day, then to simplify reconciliation, J.P. Morgan Digital Banking Cashflow360 makes use of two clearing accounts, the J.P. Morgan Digital Banking Cashflow360 Money Out Clearing Account (Accounts Payable) and the J.P. Morgan Digital Banking Cashflow360 Money In Clearing Account (Accounts Receivable). To properly integrate with Sage Intacct and J.P. Morgan Digital Banking Cashflow360, these will need to be created as checking accounts in Sage Intacct and mapped to a corresponding GL account.

J.P. Morgan Digital Banking Cashflow360 Money Out Clearing account

If using Accounts Payable in J.P. Morgan Digital Banking Cashflow360, create the J.P. Morgan Digital Banking Cashflow360 Money Out Clearing Account as a checking account in Sage Intacct and associate it with a corresponding GL Account.

NOTE: If multiple J.P. Morgan Digital Banking Cashflow360 accounts will be syncing to the same Sage Intacct environment, a separate J.P. Morgan Digital Banking Cashflow360 Money Out Clearing Account will need to be created for each entity. Best practice is to include the Entity ID in the Bank name (e.g. J.P. Morgan Digital Banking Cashflow360 Money Out Clearing - US).

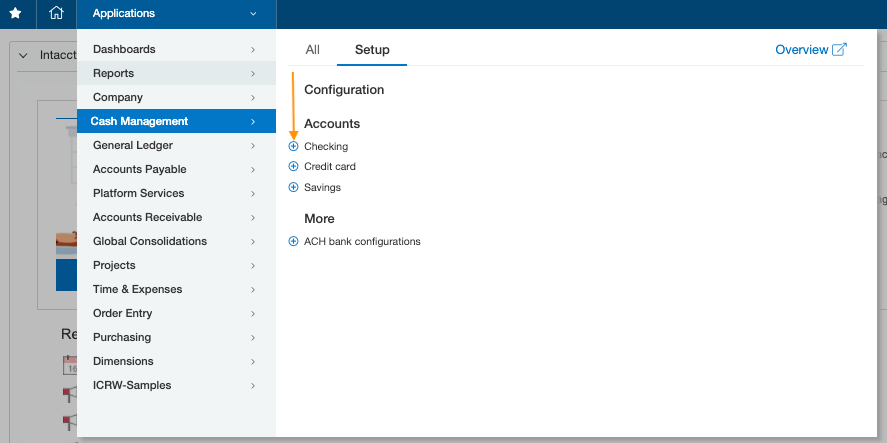

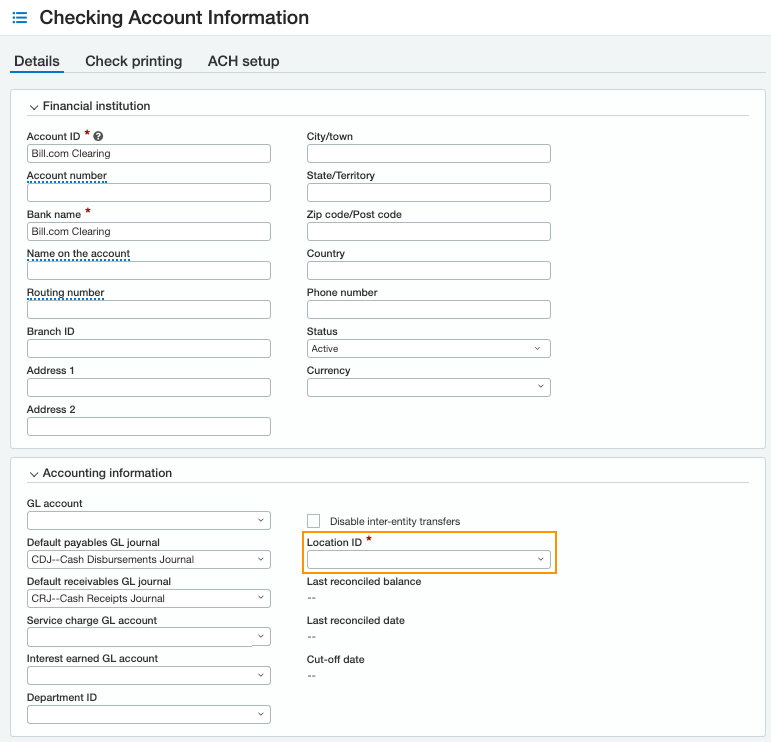

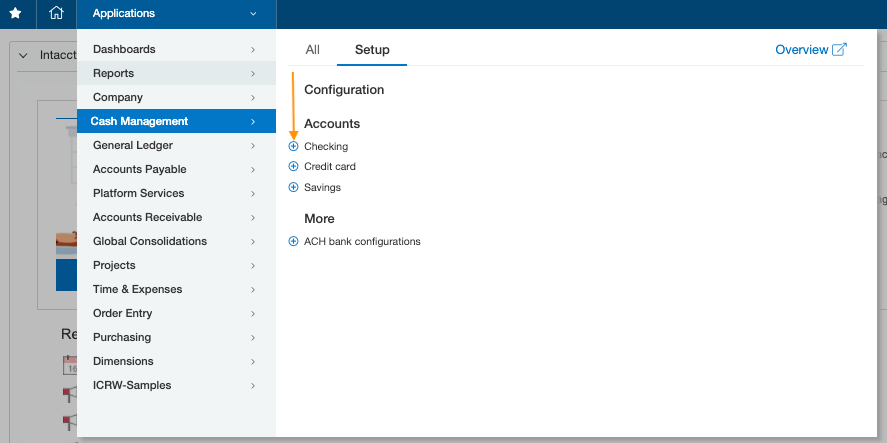

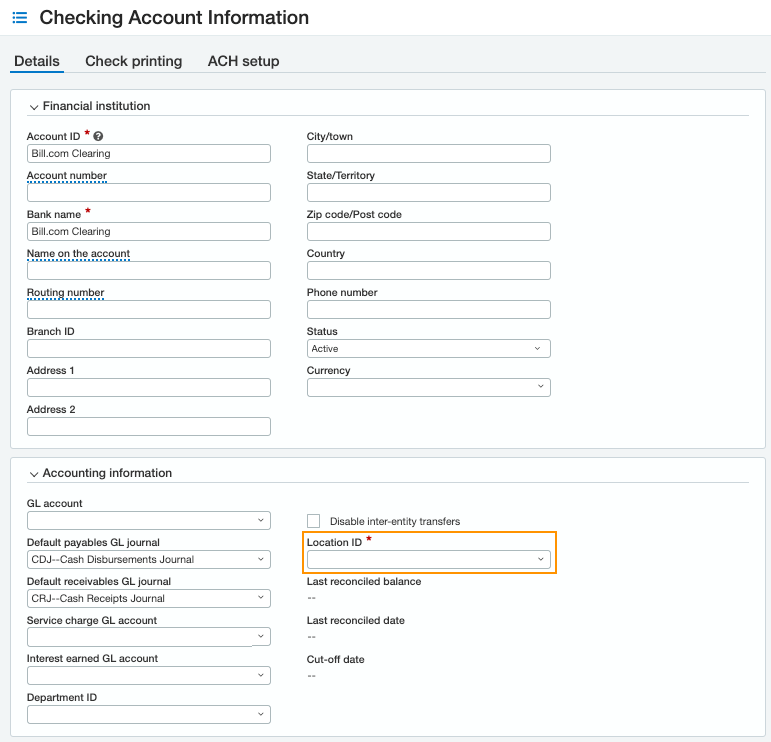

- At the Root/Top Level in Sage Intacct, navigate to Cash Management > Checking Accounts > Add

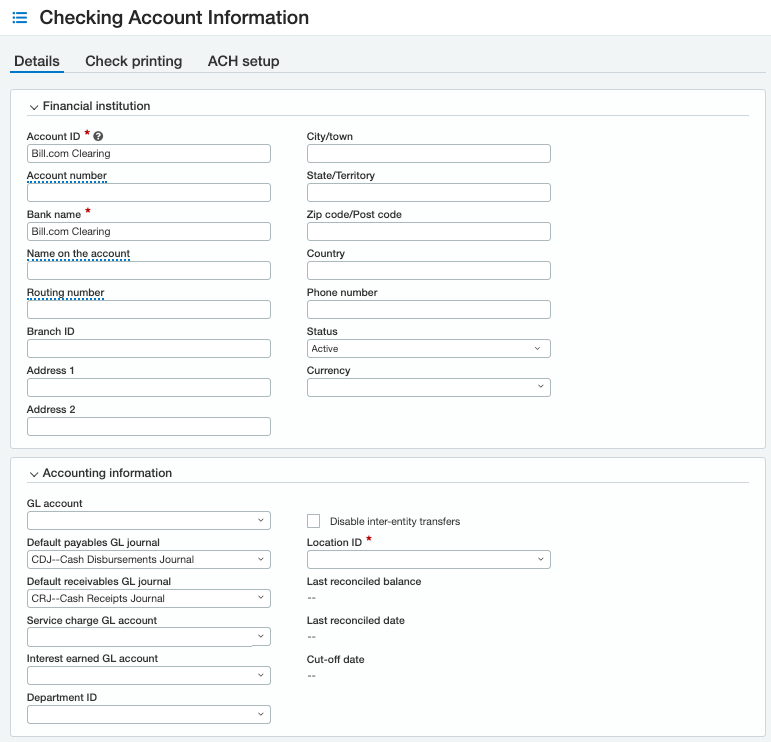

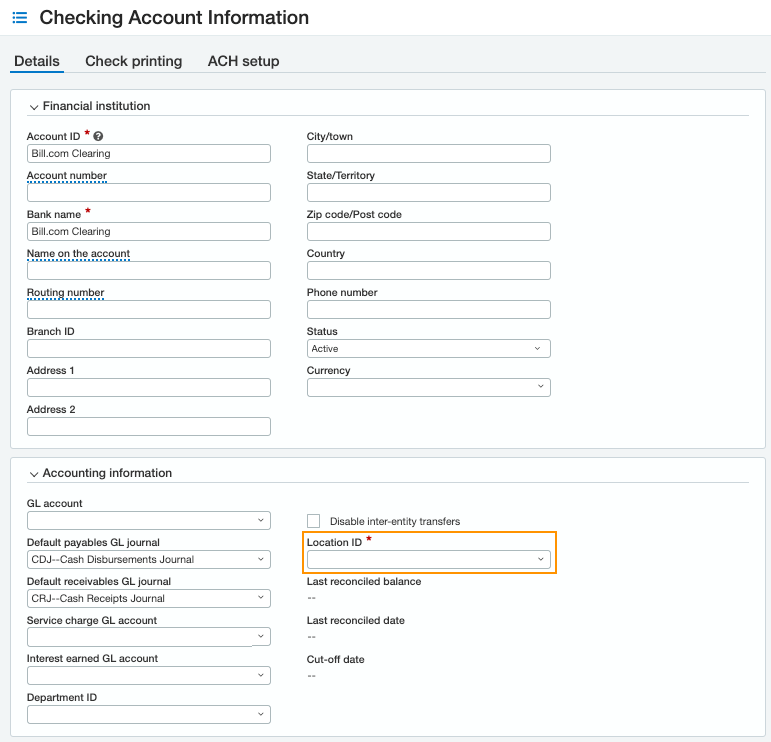

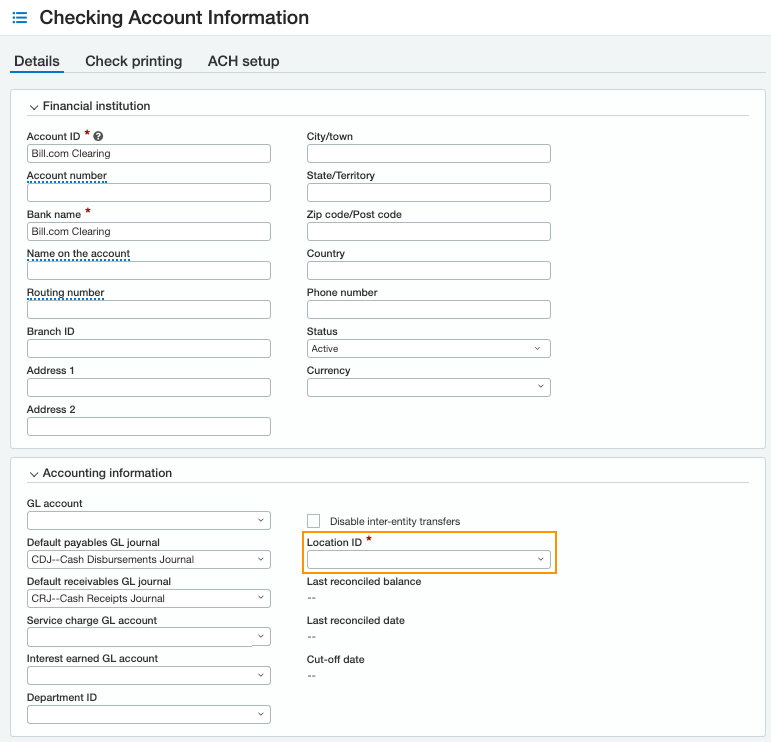

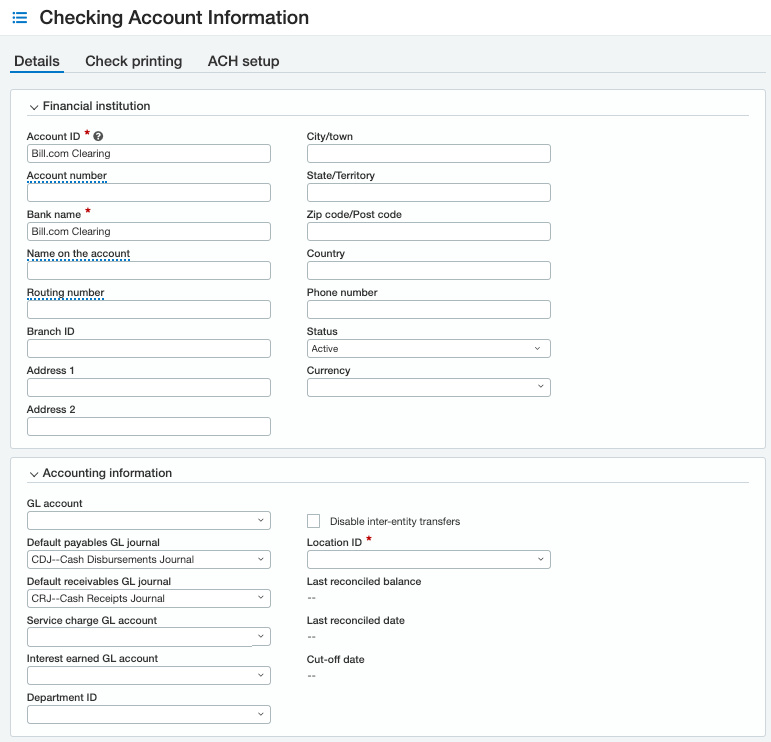

- Under Financial institution, enter the following field values:

- Account ID: J.P. Morgan Digital Banking Cashflow360 Clearing

-

Bank name: J.P. Morgan Digital Banking Cashflow360 Money Out Clearing

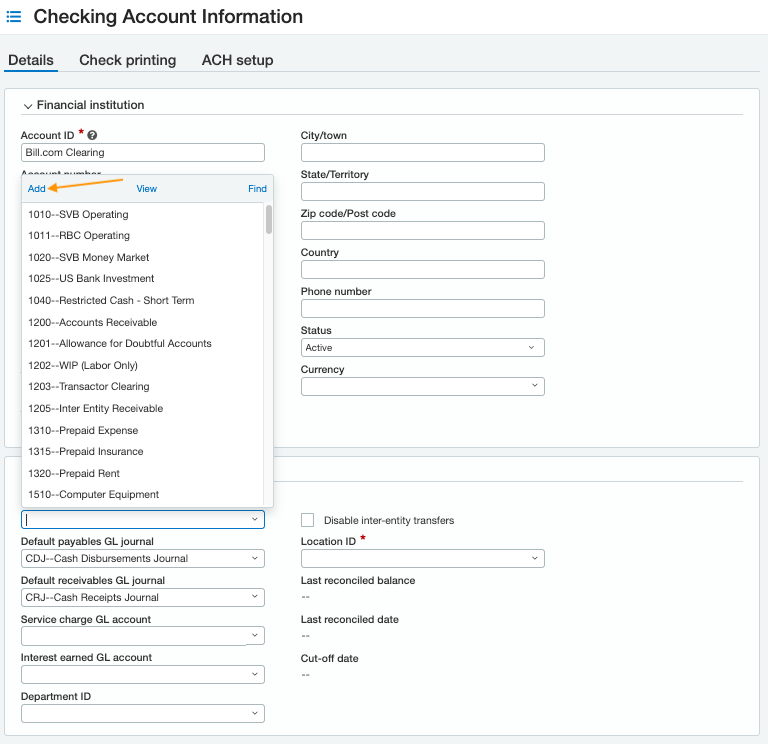

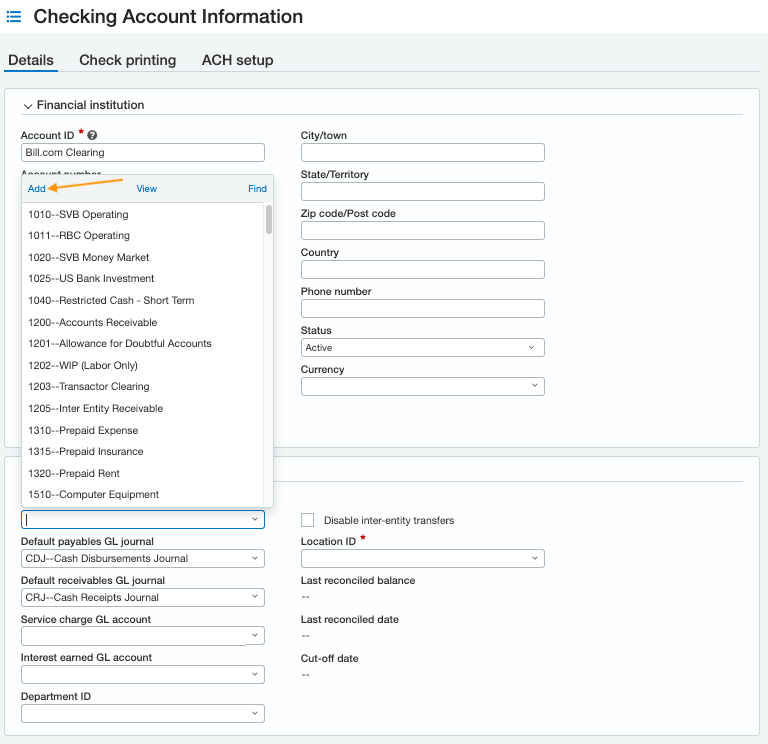

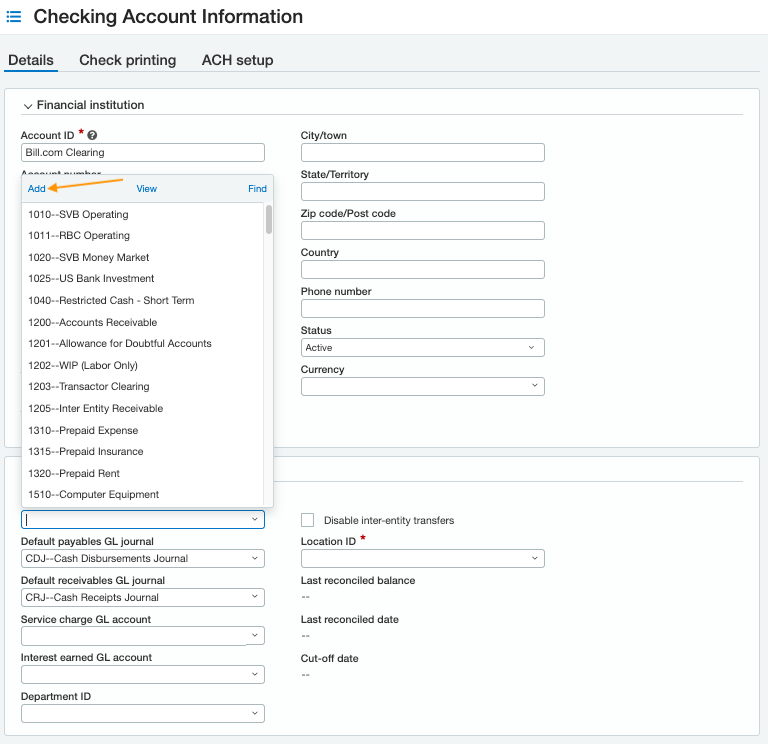

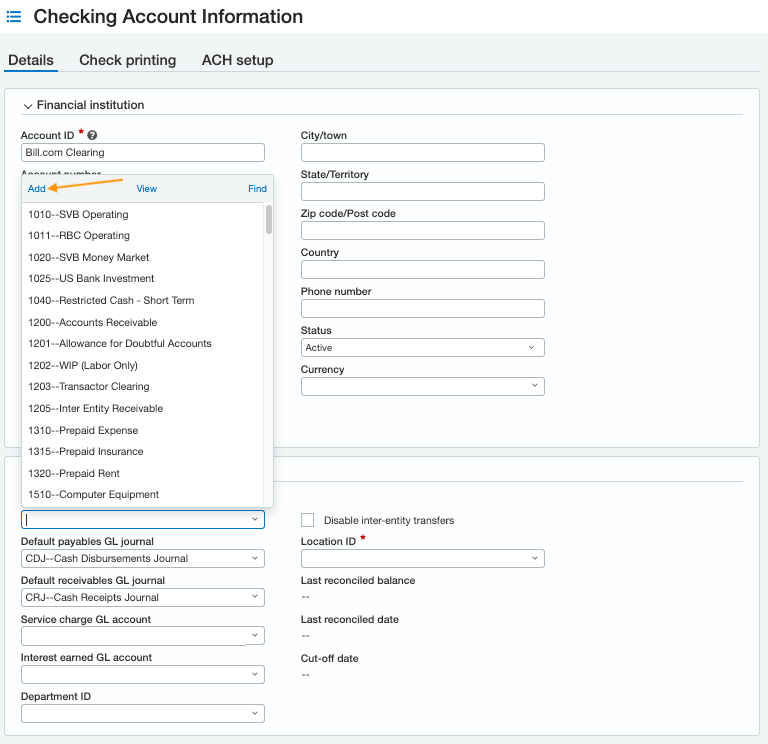

- Under Accounting information, select the GL account drop-down menu and select Add

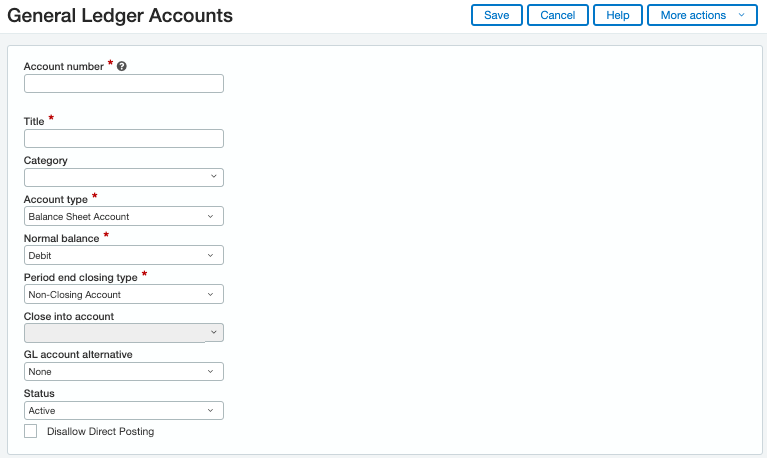

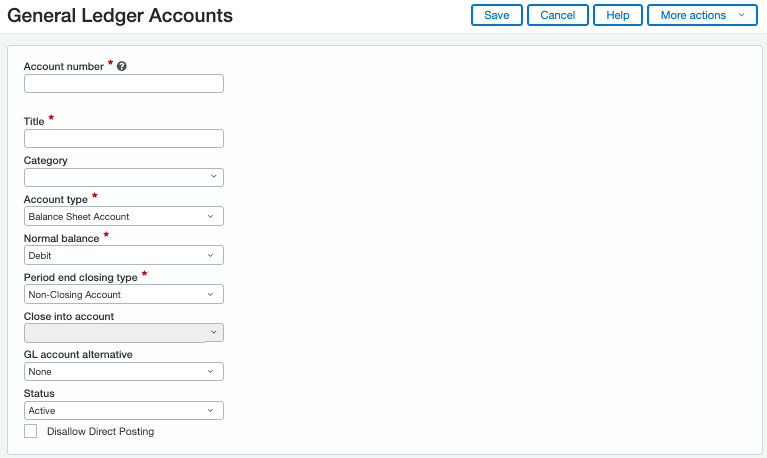

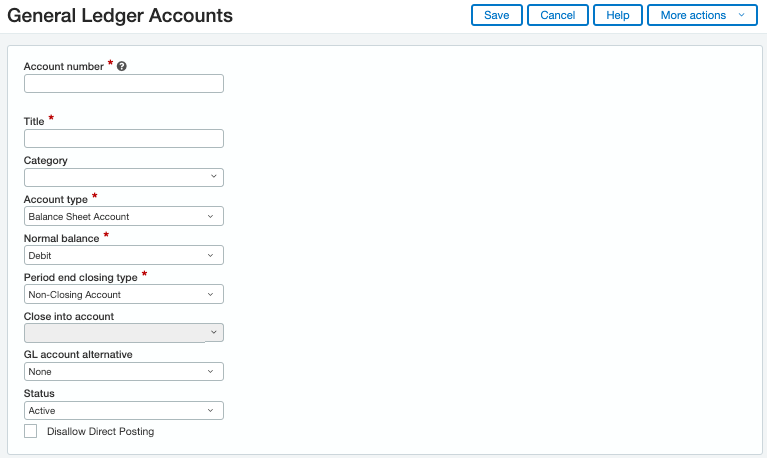

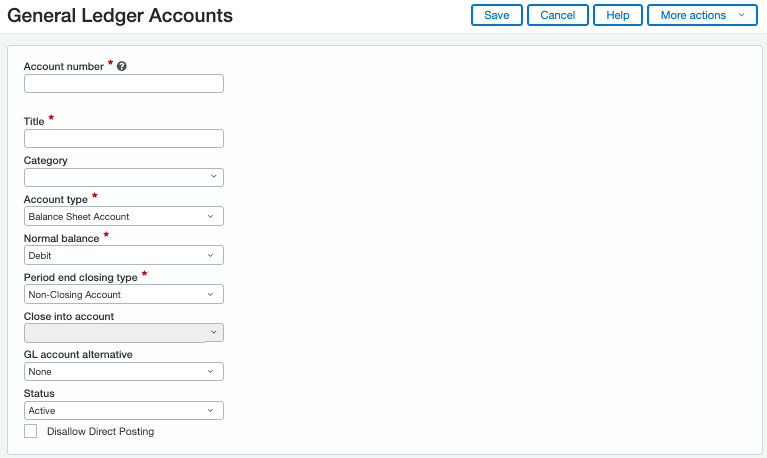

- Enter the following field value:

- Primary/Sub Account Number: Use any available GL account number

- Title: J.P. Morgan Digital Banking Cashflow360 Money Out Clearing

- Account Type: Balance Sheet Account

- Normal Balance: Debit

- Period End Closing Type: Non-Closing Account

-

Dimension settings: Do not select any dimension settings

- Select Save

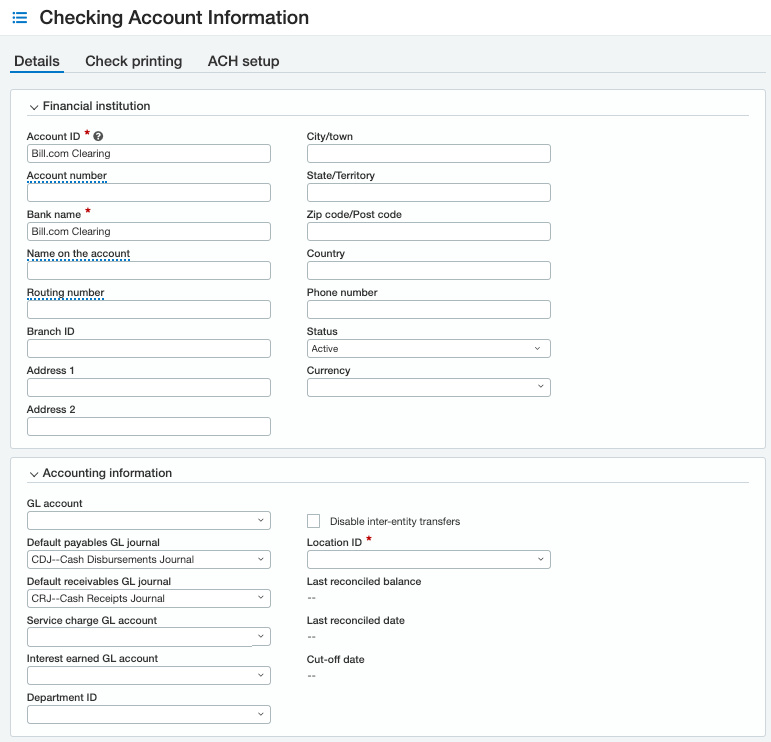

- If using a multi-entity Sage Intacct environment, select the Entity/Location ID that corresponds to this bank account

- With single-entity Sage Intacct environments, inter-entity (company) transfers are not required. Check the Disable inter-entity transfers box.

- With single-entity Sage Intacct environments, inter-entity (company) transfers are not required. Check the Disable inter-entity transfers box.

- Select Save

J.P. Morgan Digital Banking Cashflow360 Money In Clearing account

If using Accounts Receivable in J.P. Morgan Digital Banking Cashflow360, create the J.P. Morgan Digital Banking Cashflow360 Money In Clearing Account as a checking account in Sage Intacct and associate it with a corresponding GL Account.

NOTE: If multiple J.P. Morgan Digital Banking Cashflow360 accounts will be syncing to the same Sage Intacct environment, a separate J.P. Morgan Digital Banking Cashflow360 Money In Clearing Account will need to be created for each entity. Best practice is to include the Entity ID in the Bank name (e.g. J.P. Morgan Digital Banking Cashflow360 Money In Clearing - US).

- At the Root/Top Level in Sage Intacct, navigate to Cash Management > Checking Accounts > Add

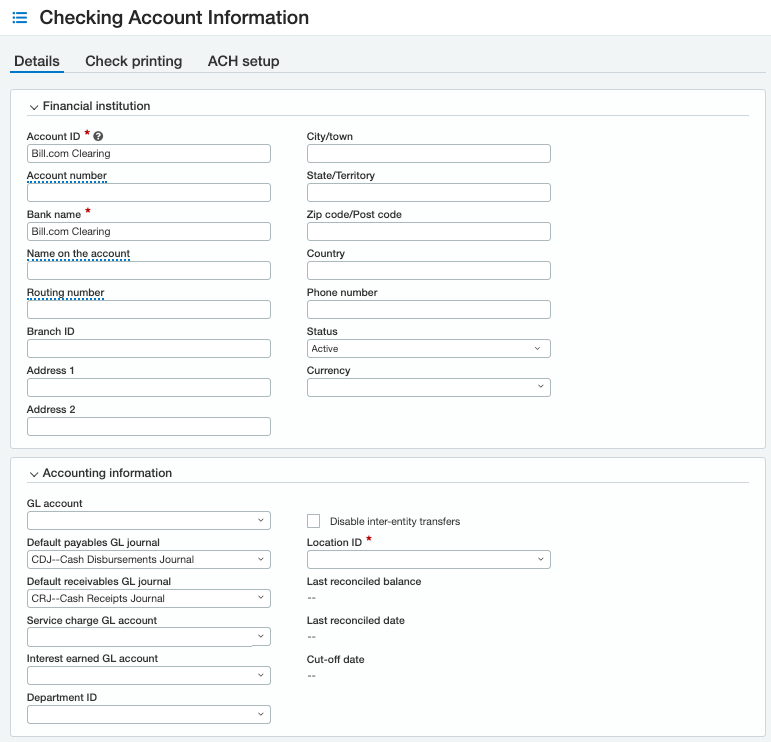

- Under Financial institution, enter the following field values:

- Account ID: J.P. Morgan Digital Banking Cashflow360 Clearing

-

Bank name: J.P. Morgan Digital Banking Cashflow360 Money In Clearing

- Under Accounting information, select the GL account drop-down menu and select Add

- Enter the following field values:

- Primary/Sub Account Number: Use any available GL account number

- Title: J.P. Morgan Digital Banking Cashflow360 Money In Clearing

- Account Type: Balance Sheet Account

- Normal Balance: Debit

- Period End Closing Type: Non-Closing Account

-

Dimension settings: Do not select any dimension settings

- Select Save

- If using a multi-entity Sage Intacct environment, select the Entity/Location ID that corresponds to this bank account

- With single-entity Sage Intacct environments, inter-entity (company) transfers are not required. Check the Disable inter-entity transfers box.

- With single-entity Sage Intacct environments, inter-entity (company) transfers are not required. Check the Disable inter-entity transfers box.

- Select Save

ACCOUNT SETUP View all

QuickBooks Desktop View all

Import / Export View all